How To Identify Different Types of Mortgage Fraud and Reduce Risks With Truework

Mortgage fraud is a key issue that impacts home buyers, sellers, and lenders. Take it from CoreLogic’s 2023 Mortgage Fraud Report, which stated that one in every 134 mortgage applications showed signs of fraud.

Deceptive mortgage applications can range from fraud for housing, where potential homeowners try to increase their chance of getting their application approved by altering information, to business schemes, where individuals commit fraud for financial gain.

For example, Los Angeles County describes real estate scams where fraudulent borrowers take out mortgage loans without the intention of repaying them, leading lenders to foreclosure.

Understanding how fraud can occur on a mortgage application is crucial to catching fraudulent applicants and lowering lender risk. Keep reading to learn the common types of mortgage fraud and the steps mortgage professionals can take to avoid them.

Understanding mortgage loan application fraud

Mortgage fraud refers to any unethical practices buyers or sellers use during the home purchase and mortgage application process. Fraud frequently involves intentionally misrepresenting information or other deception aimed at financial gain for one or more parties.

Common areas of deception include:

- The appraised value of a property.

- The income, assets, or liabilities of the buyer.

- The identity of the buyer or resident of a home.

- How a property will be used (as a primary residence or a rental property).

Buyers may misrepresent assets, identity, or property usage to secure a loan they might otherwise be denied. On the other hand, sellers may misrepresent the home’s value in an appraisal to secure a higher selling price.

The importance of preventing mortgage fraud for lenders

When a potential home buyer submits a loan application that contains fraudulent information or documents, it exposes the lender to a higher risk of loan defaults, resulting in financial loss and loss of reputation.

Here’s a closer look at the adverse impact mortgage fraud has on lenders:

- Financial loss: Mortgage fraud can lead to higher rates of loan defaults, resulting in financial loss for lenders due to increased foreclosures and the associated legal fees and court costs.

- Reputational damage: Mortgage lenders rely on their reputations to attract borrowers and investors. Falling victim to mortgage fraud can hurt their credibility and make it difficult to generate new business.

- Failure to protect borrowers: Borrowers who fall victim to seller fraud can suffer from financial losses, which could lead to legal consequences for the lender.

As such, identifying and preventing mortgage fraud is crucial for any lender who wants to reduce their overall risk, maintain a positive brand reputation, and protect their borrowers.

Types of mortgage fraud

If mortgage fraud looked the same every time, detecting and mitigating would be much simpler, but that’s not the case. Mortgage fraud can be thought of as an umbrella category that includes several types of deceptive practices.

Here are the most common types of fraud seen in mortgage applications and the signs lenders can use to detect them.

False identity fraud

Identity fraud occurs when someone wrongfully obtains and uses someone else’s personal information like name, address, and social security number to apply for a mortgage. In addition to stolen identities, identity fraud on a mortgage can include altered identities, altered credit scores, and fabricated identities.

Signs of identity fraud on a loan application can include inconsistencies in personal information, such as addresses, names, credit history, and social security numbers. Upon closer inspection, the information provided by the applicant may also not match official records.

Identity theft is usually more difficult to detect than other types of mortgage fraud. That said, the overall instances of identity fraud in mortgage applications are relatively low and represent less than 2% of all fraud concerns (i.e., one in every 12,659 loan applications).

Occupancy fraud

Occupancy fraud occurs when applicants deliberately provide false information about how they plan to use a property. A common example is when an applicant says they intend to use the home as a primary residence but instead plan to rent out the property for income.

Compared to owner-occupied primary residences, investment properties are more likely to fall into disrepair if the owner experiences financial trouble.

To offset this risk, lenders typically price loans higher for a mortgage on an investment property. Falsely applying for a loan as a primary residence allows the applicant to secure more favorable loan terms and mortgage rates at the lender’s expense.

Some red flags for lenders include appraisals that include how rent payments would impact the property's value, which signals they want to see its worth as a rental property, not a primary residence. Very large down payments can also be a sign because they are a tool investors can use to move the sale through faster, knowing they plan to earn income off the property.

Income fraud

Income fraud happens when potential homeowners misrepresent income or employment. Applicants may report false income and alter documents, such as pay stubs or tax forms, to support the amount they listed.

If this type of fraud goes undetected, approved homeowners may be unable to pay back their loans, leading to an increase in defaults or foreclosures for the lender. Income fraud can be identified by signs such as missing or falsified financial documents.

As technology has made it easier to forge or edit documents, it has become increasingly challenging for loan officers to catch income fraud. This is especially true when loan volumes are high, and teams have less time to review each document carefully.

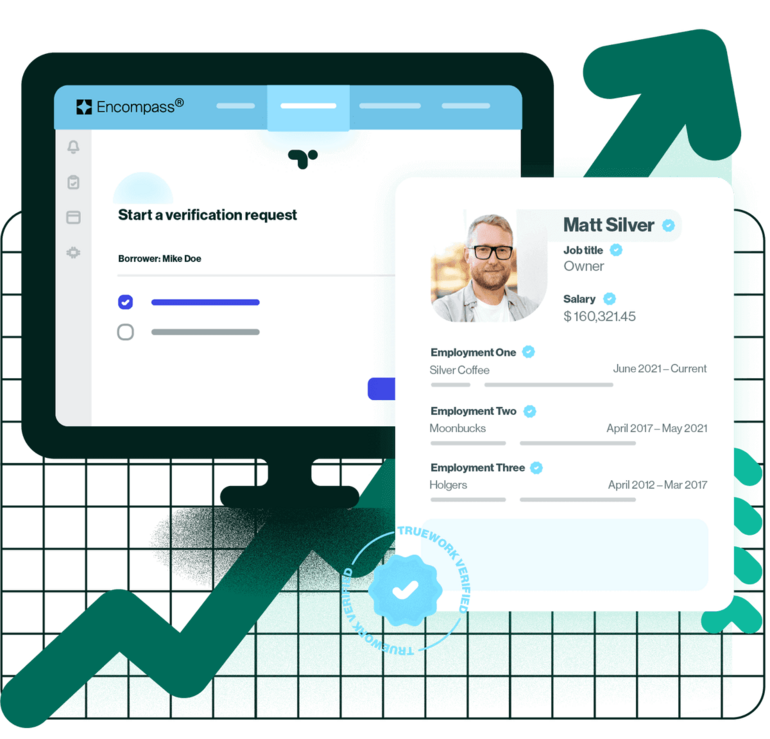

As such, income and employment verification solutions are an essential tool to help reduce the risk of income fraud. Lenders can use Truework to detect and prevent income fraud by coordinating income verification across several methods.

Truework also provides direct integrations with several loan origination systems to create a more streamlined verification and application process for borrowers.

Straw buyer

Straw buyers are applicants who request loans in place of others who can't secure them. After the loan gets approved and they secure the property, the straw buyer transfers the property title to the person they are representing.

Signs of a straw buyer include funds from an organization rather than an individual or scenarios when someone other than the buyer plans to live in the property. Lack of in-person meetings or phone calls between the buyer and seller can also be indicative of the straw buyer scam.

Illegal property flipping

Property flipping is a common practice in the housing industry. In most cases, the property owner holds on to the property for some time with the primary intention of selling it for profit later.

Illegal property flipping refers to situations where scammers purchase a property and immediately resell it for more at an artificially inflated price, usually by using a fraudulent appraisal to mislead the new purchaser. These mortgage fraud schemes can lead to a higher rate of loan defaults for lenders.

Common red flags for lenders include the presence of a straw buyer, sales in which a home was acquired through foreclosure, or a suspiciously high appraisal.

Home appraisal fraud

Appraisal fraud occurs when an appraiser artificially inflates or deflates the value of a property, usually in collusion with one of the parties.

Sellers may use this to get higher than fair market value with an inflated appraisal, while buyers may work to get a deflated appraisal to secure a loan lower than the property’s value.

Common signs include multiple appraisals with different values, selective comparable values in the appraisal, and incomplete or inaccurate appraisals.

Non-arm’s-length transaction

A non-arm's-length transaction happens when the buyer and seller know one another personally. This can result in collusion between parties or one party having undue influence over the other, making the deal less fair and independent.

Lenders should look for transactions between people with a prior relationship and transactions without a real estate agent.

Asset rental

Asset rental fraud occurs when applicants borrow someone else’s money (or other assets) to make themselves appear more qualified when applying for a mortgage loan.

After the loan closes, the potential homebuyer typically returns the money to the person they borrowed from. Some warning signs include poor credit, inconsistent employment information, or income that can’t be easily verified, such as rental or freelance-based income.

Undisclosed real estate debt

This happens when the applicant deliberately fails to mention existing real estate debt or past disclosures. Warning signs include incomplete or inconsistent financial statements, buyers rushing through the sales process, and applicants who are reluctant to answer questions about the property.

Equity skimming

Equity skimming is a type of straw man scam where investors use a third party to purchase a property.

Once the loan is secured, the straw man uses a quit claim deed to give property rights to the investor. The investor then rents out the property for income without making mortgage payments, and this continues until lenders have to foreclose on the loan.

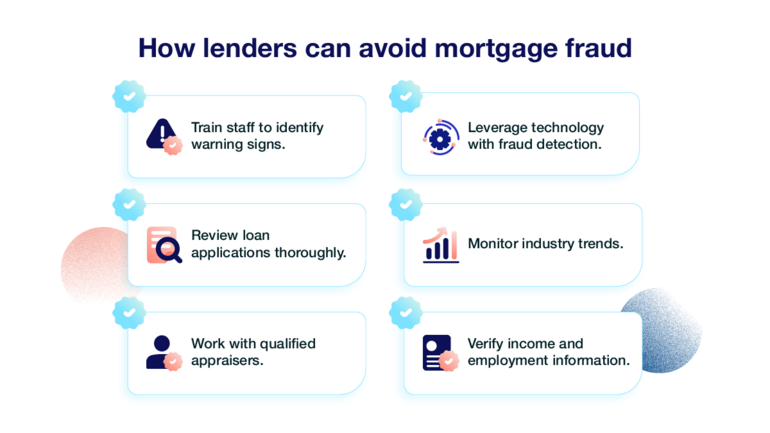

How lenders can avoid mortgage fraud

Dealing with the consequences of mortgage fraud can be frustrating, to say the least. For lenders who want to take a more proactive approach, here are some best practices to detect fraudulent activity and lower your risk of defaults and financial loss.

Train staff to identify warning signs

Understanding common warning signs is key to preventing fraud. For best results, ensure that all staff members are trained to look for and identify the signs of mortgage fraud listed above.

Review loan applications thoroughly

This should go without saying, but lenders should review all applications and loan documents thoroughly to ensure completeness. After all, missing or falsified information is a common sign of fraud.

Lenders should also call references and use third-party sources to verify the applicant’s financial information.

Work with qualified appraisers

By building relationships with qualified appraisers, lenders can help prevent illegal property flipping and home appraisal fraud. If loan applicants need an appraisal, lenders can require them to use professionals in their network.

Leverage technology solutions with fraud detection

Document fraud has become increasingly sophisticated, which means the human eye can’t easily catch certain deceptions. Using solutions with fraud detection can help you detect warning signs that are harder to spot.

For example, Truework’s automated income verification platform gives you access to source data and includes fraud detection tools for manual verifications. Specifically, Truework Documents automatically reviews each applicant file and flags potential fraud so lending teams can review it.

Monitor industry trends

Lenders should stay informed about the latest types of fraud impacting the mortgage industry. That way, they can understand the warning signs and inform their team accordingly.

Monitoring mortgage lending news and keeping a list of investors or individuals who have committed mortgage fraud can also help lenders steer clear of repeat fraudsters.

Verify income and employment information

Verifying income and employment information is essential to reducing the risk of mortgage fraud, and using an automated verification provider can make the process easier for lenders.

That said, ensuring the verification provider offers an excellent borrower experience is crucial. Truework’s all-in-one automated income verification platform gives lenders access to several reliable income verification methods, including Instant and user-permissioned data, while giving borrowers a seamless experience.

Beyond that, Truework selects the best verification method for each applicant, ensuring that lenders get accurate information quickly without paying for duplicate verifications.

For lenders verifying income manually, here are some tips to avoid fraud:

- Don’t rely solely on employer phone numbers provided by the applicant. Look up the employer’s information on the website to ensure you’re calling the actual reference.

- Don’t tell references the information the applicant provided. That can lead to collusion.

- Don’t rely solely on family to provide references for an applicant.

How Truework helps mortgage lenders avoid income and employment fraud

Truework is a comprehensive income and employment verification platform that helps lenders detect signs of fraud early while supporting fast turnaround times in the application process.

Here’s how Truework can help lenders detect and prevent income and employment fraud.

Source-of-truth payroll data

Truework Instant and Credentials use source-of-truth data to verify applicant income and employment. These methods provide wide coverage so lenders can use source-of-truth data to verify more applicants, including those with 1099 income.

Using these methods means lenders don't need to rely on physical and digital files borrowers can alter. They also require less work than document uploads, creating less friction in the application process.

Fraud detection for manual verifications

Truework Smart Outreach is used for manual verification when other methods aren’t available. When using this method, Truework’s team always validates contact information using neutral third parties and doesn’t reveal applicant-supplied information when verifying with references.

Automated fraud detection for document uploads

Truework Documents converts applicant-supplied files into a standard data format that makes it easier to detect anomalies that may signal fraud, such as key numbers not matching. The platform automatically flags potentially fraudulent documents for further review so you can improve risk management while keeping operations streamlined.

Steer clear of mortgage application fraud with Truework

As a lender, it might be tempting to think you aren’t the primary target for property fraud. But that’s not the case. There are several types of mortgage fraud schemes aimed at lenders that can result in financial loss, reputational damage, and disastrous borrower experiences.

Understanding the types of fraud and their common warning signs is an excellent place to start when it comes to preventing them. To further reduce your risk of mortgage fraud, having an automated income and employment verification solution is crucial.

Ready to learn more?

Explore Truework Income for Mortgage today to see how you can easily access reliable income and employment data while increasing application turnaround times and creating a high-quality borrower experience.