How an Income Verification Platform can accelerate leasing efficiency for property managers

The economic situation in 2023 doesn’t paint a rosy picture for 2024 — steady inflation, the persistent threat of a looming recession, and rent prices increasing by up to 30% in some U.S. cities. Surviving these and other uncertainties requires that businesses apply creative solutions to improve operational efficiency.

For property managers who rely on elements like accurate income data to make informed decisions about applicants, implementing income verification software like Truework can provide the necessary edge to streamline the verification process and remain competitive — even during a recession.

Truework enables leasing staff to deliver value by completing tedious tasks like income verification quickly, focusing on high-impact work, delivering a high-quality customer experience, and helping them reduce delinquencies short and long-term.

How does income verification software help property managers?

Income verification software automates the process of validating a prospective tenant’s income and employment status, regardless of the employer type.

Verifying a tenant’s income status is an essential part of the background checks that a property manager or leasing agent does to determine if an applicant can afford to lease their property and won’t be late with future rent payments.

Typically, a property manager or leasing agent would request proof of income documents like pay stubs or bank statements from the applicant and then manually verify these documents, which can take anywhere from a few days to months.

After all, employee records could come from different sources (e.g., proof of income letters from employers, tax return or wage transcript from the IRS, etc.), each with different processes for requesting verification and timelines for getting a response.

The longer the tenant screening process, the more likely you are to provide applicants with a negative experience that prompts them to take their business elsewhere and incur losses due to missing rental income.

Automated income verification software like Truework helps solve that. Truework supports your tenant screening process to help you avoid extended vacancies and improve the customer experience.

It also combines multiple verification technologies and orchestrates requests across various verification methods, empowering property managers to maximize the number of applicants who have their income automatically verified and streamlining operations by only requiring one tool to oversee the verification process.

Benefits of income verification software for property managers

Property managers have established processes for verifying income details for potential tenants. However, while these systems do get results, they may not be the most efficient or cost-effective way of confirming a prospective tenant’s income or employment status.

Here are some of the advantages that come with moving to an automated income verification platform like Truework:

Faster tenancy application times

The longer you wait for the results of a traditional income verification request, the longer you have an unoccupied rental property that could be earning income. For a property management company that receives many applications, these wait times can quickly add up and cause frustrations for applicants and an unhealthy strain on your employees.

By using an income verification platform to verify income as part of the application, your team can get access to instant income reports from verified sources. These faster turnaround times mean leasing teams can make faster decisions and get applicants into properties as soon as possible.

Improved fraud detection and prevention

Your team may have a keen eye for fraudulent applications. But putting that keen eye to use frequently requires a hefty time investment your team could devote to other value-creating business activities.

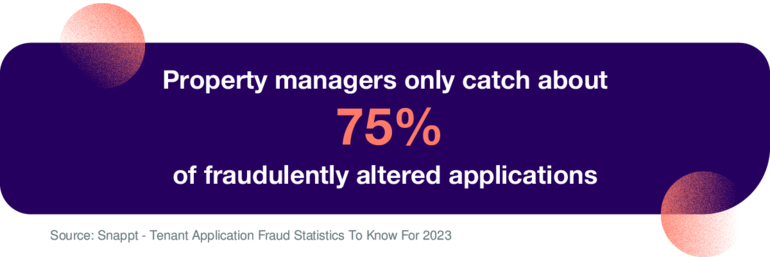

After all, even if they’re experts, some fraudulent applications will remain unnoticed — property managers only catch about 75% of fraudulently altered applications. These missed cases can result in increased operational costs in the form of late or unpaid rent by these tenants or costly eviction processes.

The risk of wily renters impacting your business can be reduced by an income verification platform that allows applicants to connect directly to their payroll or employer system and provide property managers with a single source of true income information.

Moreover, when documents need to be collected, an income verification platform can flag potentially fraudulent documents and help teams prioritize documents for further review.

Reduce repetitive manual work for leasing staff

Despite industry challenges, the 2023 Property Manager Benchmark Report by AppFolio notes that more than half of the surveyed property managers intend to hire additional employees in the next year. The report also mentions freeing staff from labor-intensive processes as one of the top motivations for improving operational efficiency.

As talent retention remains key in a tight labor market, businesses can increase employee satisfaction by improving processes and cutting down on manual, time-intensive tasks.

Income verification software makes this possible by automating time-consuming and complex tasks, empowering your team to embrace productivity.

Your team won’t have to spend precious hours verifying employment by reviewing application documents, screening reports, or calling employers to verify previous and current income information.

How Truework expedites income verification for property managers

As an income verification platform, Truework has several features that give it an advantage over manual verification methods. If you are a property manager looking to streamline your existing processes, here’s why you should use Truework for your income verification process.

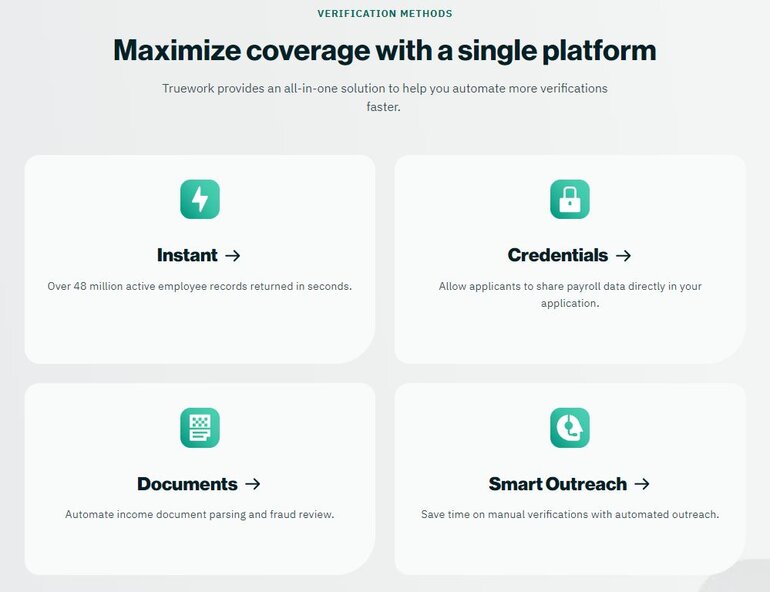

Truework verifies employee records and applicant’s income information using four methods:

- Instant verification, which provides real-time results for verification requests by querying a database of over 40 million employee records generated from partnerships with employers, Human Resource Information Systems (HRIS), and payroll systems.

- Consumer-permissioned verifications, which allows applicants to log in and access their payroll provider accounts to share verified employment and income data. Through partnerships with these payroll system providers, Truework can directly access user-permissioned data to verify income details.

- Automated outreach, for verification cases where income data isn’t readily available, and human intervention is required to contact an applicant’s employers and verify income data.

- Document fraud review, which works specifically with income documents like paystubs submitted with a tenancy application as proof of funds. Truework can parse these documents to verify their authenticity and flag suspicious documents for further review.

Flexible implementation

How you integrate Truework’s income verification into your tenancy application process is totally up to you.

Our user-friendly web app is optimized for mobile and desktop devices. Property managers and leasing agents can easily create an account and sign up to submit or follow up on income verification results from a web browser.

Truework can be integrated into online rental applications by embedding Truework Direct’s customizable widget or property management software using the Truework API with just a few lines of code.

That way, teams can take advantage of the income verification features that Truework provides within a system they are already familiar with.

Improve your leasing efficiency with Truework

The efficiency of the income verification process and the accuracy of the information it provides are essential to the success of a property management business.

Truework offers the advantage of speeding up the process while providing accurate information and reducing the risk of fraudulent income reports. With these benefits, businesses can accelerate tenant screening and approval times and reduce busy work for their teams.

Ready to learn more?

Get in touch with Truework today to learn more about how you can simplify income verification for you and your team.