How automated income verification reduces your risk of rental application fraud

With steady inflation, record-high rents now leveling, and a potential recession still not in the rearview mirror, operational efficiency has never been more critical for property managers.

And although these challenges may feel new, others have been prevalent in property management for decades, like rental application fraud.

Rental application fraud occurs when a tenant falsifies their information (e.g., income) while applying for a property. While it’s always been difficult to deal with, the advent of technology and digital-first interactions have made the signs of fraudulent applications more difficult to spot and deal with — impacting operations and revenue.

As we close out 2023, property managers who identify and apply potential improvements to the way they deal with fraudulent applications will fare far better in 2024 and differentiate themselves as a business.

Adopting an income verification platform like Truework empowers leasing staff to deliver value by expediting time-intensive tasks like income verification and, in turn, make it so fraudulent income doesn’t get through and create delinquencies, enabling staff to focus on the highest leverage work and deliver a better customer experience.

The rising issue of rental application fraud

Fake income verification for apartments and houses is becoming a more prevalent problem, with about 84.3% of property managers reporting that they’ve dealt with the issue in 2023.

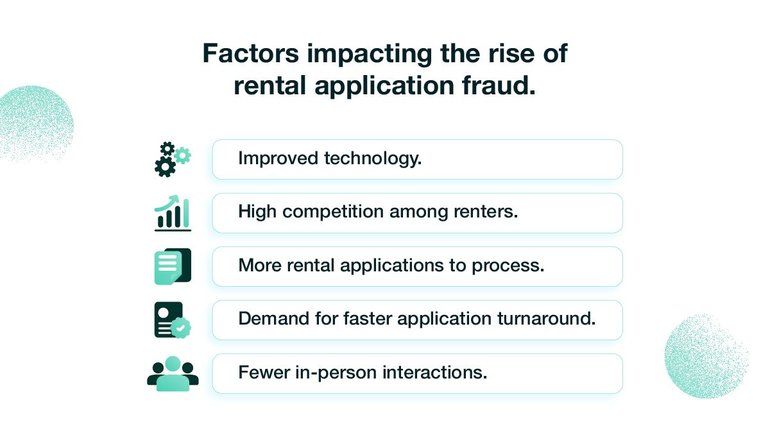

This rise in application fraud can’t be pinpointed to a single cause. Instead, there are several factors that, when added together, result in an increase in applications with false information and simultaneously make it harder for property managers to identify fraud. These include:

- Technology: Consumer technology has made it easier for applicants to create false documents, fake employment, and alter financial documents such as bank statements, pay stubs, or tax returns.

- Higher competition among renters: Highly competitive housing environments put additional pressure on rental applicants. In 2022, there was an average of 14 applicants competing for each vacant rental listing. Increased competition may lead to some renters forging documents or lying about income to get their applications through.

- Demand for faster application decisions: Faster application approvals help property managers keep vacancy rates low. And whether for loans or apartments, consumers expect faster turnarounds and decisions on their applications. These factors put added pressure on property managers to get through more applications in less time and increase the chances of missing fraudulent information.

- Fewer in-person interactions: In-person tours and application drop-offs allowed property managers to observe potential tenants and get a sense of who they are. The growing popularity of virtual tools and online applications means it’s possible to select tenants without ever meeting them in real life. That makes it difficult for property managers to identify suspicious behavior, such as acting nervous or contradicting their employment information in conversation.

For property managers, it’s difficult to balance fast turnaround times and high-quality applicant experiences with making sure they reduce risk in the tenant screening process. But with the right tools in place, property managers and leasing agents can mitigate risk while driving operational efficiency and delivering the best applicant experience.

Technology like Truework can help streamline the process by automating income verification and proactively flagging potentially fraudulent documents.

For example, Truework Documents converts proof of income documents into a standard data format that allows you to automate the review process. The Documents feature can quickly identify documents that may have been altered and let your team know which applications require further review so you can allocate your time more effectively.

How rental application fraud costs property managers

Potential tenants submitting fraudulent income information without detection can cause a host of ongoing problems for you and your staff.

The financial costs of rental application fraud

First and foremost, failing to identify application fraud increases the risk of financial loss due to late or missing payments. When a tenant doesn’t have the income to pay rent consistently, it falls on you to chase down late payments.

If nonpayment continues to escalate, you may need to evict tenants. While eviction may seem extreme, it’s not that uncommon.

According to Eviction Labs, landlords filed for almost 970,000 evictions in 2022. And the claims in Cincinnati, Dallas, Houston, New Orleans, New York City, and Philadelphia alone amounted to nearly $1.2 billion.

The eviction process is rarely pleasant. It can easily consume more time and money than expected. In fact, depending on your state’s laws, you can expect to spend anywhere from $500 to $10,000 per eviction.

The costs associated with eviction can include:

- Lost rent

- Court fees

- Attorney fees

- Sheriff’s fees (if enforcement becomes necessary)

- The cost of preparing the unit for new potential tenants (and repairs if the previous tenant damaged the property)

While eviction costs vary widely between states, any cost is too high when property managers have access to cost-effective technology to mitigate fraud risk. With Truework Income, you can access multiple sources of accurate income and employment information, such as user-permissioned data and instant verifications, all in one platform.

User-permissioned data gives you access to actual pay stub data directly from an applicant’s employer, reducing the risk of someone uploading fake pay stubs on their rental application. Instant verifications, on the other hand, give you access to more than 48 million active employment and income records for same-day approvals.

The business costs of rental application fraud

Beyond the potential financial losses, failing to identify fraud can mean that you let bad tenants move in, which increases the risk of creating a negative experience for your other renters.

If you’re spending most of your time chasing down rent payments, that takes time away from your regular property management tasks. Over time, that can lead to decreased renter satisfaction and reputation damage for the rental property.

Lastly, if you have fraudsters who engage in other types of criminal activity, that puts you and the property owner at risk of being held liable for illegal activities or regulatory issues that take place on the premises.

Warning signs of rental application fraud

Understanding the warning signs of income or employment fraud can help your team determine when a potential tenant’s application warrants further review and investigation.

Here are some red flags that property managers should be on the lookout for if they want to avoid becoming a victim of income fraud:

- Lack of references

- Contradictory information

- Applicant doesn’t provide complete information

- Applicant insists on giving you a physical credit report

- The background check doesn’t match the applicant’s rental history

- Inconsistent information on a document, such as bank account balances that don’t reflect transactions

That said, manually checking for each of these warning signs can be time-consuming. Not to mention, it’s a process that’s prone to human error.

Instead, property managers can mitigate fraud with the help of income verification platforms that give them access to more accurate sources of information and automatically identify suspicious documents.

How to mitigate the risk of rental application fraud with automated income verification

While technology has made it easier for applicants to falsify information, it can also help property managers identify fraudulent documents and avoid the risk of delinquency.

Here’s how automated income verification can help reduce rental application fraud and create a better experience for applicants and leasing staff.

Identify fraud more quickly

Yes, your leasing team has likely developed private investigator-level skills to identify fraudulent applications. But that doesn’t mean they should be spending hours reviewing documents, google searching employers, or picking up the phone to call someone.

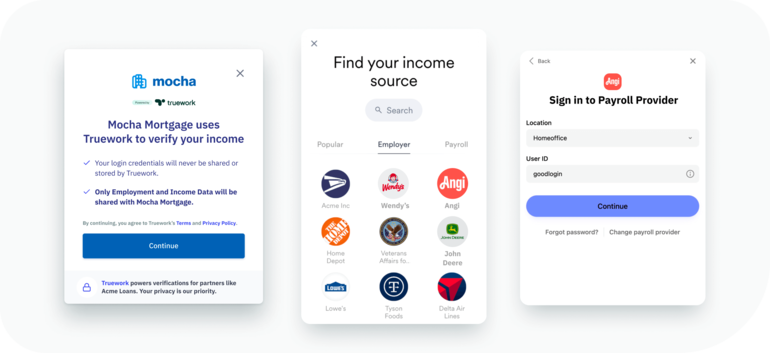

An automated income verification platform like Truework helps prevent fraud by allowing applicants to connect directly to their payroll or employer system and provide property managers with the most up-to-date source of truth income information.

In the case where documents need to be collected, an income verification platform can flag potentially fraudulent documents and help teams prioritize documents for further review.

For instance, Truework Documents automatically checks each proof of income file for abnormalities or suspicious information, like when the ending balance of a bank statement doesn’t reconcile with the total value of the transactions captured during the period.

Using more accurate and efficient income verification methods frees up significant amounts of time because you don’t have to do deep detective work on each application.

Faster application turnarounds

If your tenant screening process takes too long, you’re creating a negative applicant experience. Not to mention, waiting even two to three days to verify income before approving potential tenants can cut into your overall rental income.

Using an automated income verification like Truework to support your tenant screening process creates a better renter experience and lets you eliminate extended vacancies. Truework helps property managers make faster decisions with confidence by reducing the risk of fraud and getting qualified tenants into your properties as soon as possible.

Because Truework combines multiple income verification technologies, property managers can maximize the number of applicants who have their income automatically verified.

Not to mention, Truework is a single platform that orchestrates requests across various verification methods, which enables you to streamline operations and only require one tool for your leasing staff.

Moreover, as a Consumer Reporting Agency (CRA), Truework’s product complies with Fair Housing Guidelines and provides the most accurate data while allowing applicants to easily dispute information to get the process moving.

Less manual work for leasing staff

According to AppFolio’s 2023 Property Manager Benchmark Report, 52% of property managers are looking to hire additional employees in the next 12 months. As a result, competition for leasing staff may remain high.

Businesses capable of retaining talent in a tight labor market have the opportunity to create a competitive advantage.

Investing in technology and tools that cut down on manual, time-intensive processes can increase employee satisfaction and simplify the onboarding process for new employees by automating time-consuming and complex tasks.

With Truework Income, you can access multiple income verification methods, including instant, user-permissioned data, and automated document review.

Truework also offers Smart Outreach, which automates manual verification so your team members don’t spend most of their time calling or emailing applicants for information.

Stop rental application fraud with Truework

Income and rental application fraud is a growing challenge for property managers. Leasing teams are under pressure from both sides as they try to balance risk mitigation while attempting to process more applications faster.

Supporting your tenant screening process with the right tools allows you to create the best applicant experience possible while reducing the risk of fraud. By consistently getting qualified tenants into your properties, you’ll avoid costly financial losses and create a better experience for your renters.

Finding the right automated income verification solution can help property managers proactively identify and prevent fraud on rental applications. Not to mention, automation lets you process more applications faster without burdening your leasing staff with unnecessary manual tasks.

When looking for an income solution, you want to find a platform that uses multiple verification methods and automates the process for the majority of your applicants to maximize coverage.

Ready to learn more?

Talk to our team about how Truework Income can help you identify qualified tenants and reduce your risk of rental application fraud