Understanding the Freddie Mac Asset and Income Modeler (AIM)

With experts predicting an increase in loan origination rates in 2024, there’s an opportunity for lenders in the real estate industry to take advantage of higher demand. That said, it’s also important to ensure that more loans don’t lead to ballooning costs.

Lenders need to find ways to handle an increase in volume while keeping costs low and streamlining operations to ensure positive customer experiences and ongoing profitability.

In a survey of leaders in the mortgage lending industry, 93% of respondents said they plan to rely on new or upgraded technology to scale up in the future.

One tool that can be especially useful in expediting the loan origination process while increasing the quality of loans is the Freddie Mac Asset and Income Modeler.

What is Freddie Mac AIM?

The Freddie Mac Asset and Income Modeler, or AIM, is a tool within Freddie Mac Loan Product Advisor® (LPA) that streamlines the loan origination process.

Freddie Mac’s LPA is a tool that lets you view Freddie Mac’s loan credit requirements and credit risk to estimate the overall underwriting risk of a loan. Freddie Mac’s AIM supports this by leveraging third-party service providers to automate income assessment using borrower-approved data.

Specifically, the AIM capability allows for the use of income and employment data from third-party providers to verify and assess the following:

- Assets: It works with third parties to give you access to asset account data.

- Income: This is verified through providers that use direct deposits, payroll data, tax returns, or tax transcripts.

- Employment: It verifies employment through direct deposits and payroll data.

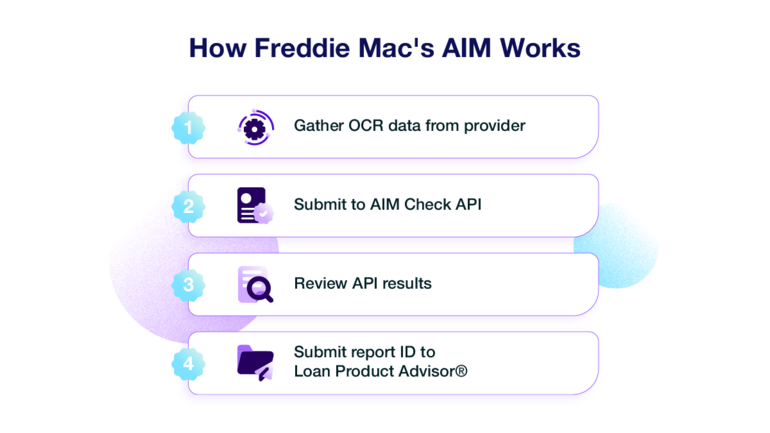

How the Freddie Mac AIM tool works

To use the AIM capability, lenders can set up integrations with their third-party provider platform, LPA, and the Freddie Mac AIM Check API. Once they set up the integration, lenders generate an asset verification report from their provider and submit it through Freddie Mac’s LPA, where it goes through the AIM tool.

Alternatively, lenders with their own optical character recognition (OCR) data can submit that information to the AIM Check API. The AIM Check API uses the OCR data to read and analyze the information from the documents provided (e.g., direct deposits, tax returns, or pay stubs), significantly reducing transcription errors.

From there, the AIM Check API generates a preliminary income report that estimates the borrower’s qualifying income amount for a Freddie Mac-eligible loan. When it’s time to submit a full application to the LPA, lenders submit the AIM Check API report to the LPA, and the AIM tool does a final income calculation.

Lenders receive the results of the Asset and Income Modeler through a feedback certificate, which includes representation and warranty relief for the asset and income calculations when available.

Specifically, the AIM tool may provide representation and warranty relief for the accuracy and integrity of asset data, income calculation, income data, and business and income analysis.

With representation and warranty relief, lenders further lower their risk of loan buybacks as it ensures they won't be held responsible for the borrower income calculation done by the AIM tool.

Benefits of using Freddie Mac's AIM tool

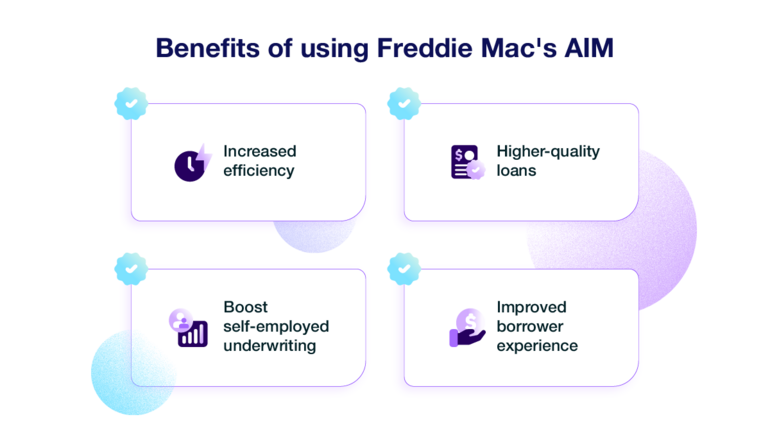

Freddie Mac’s automated income assessment tool is an excellent way for lenders to simplify the loan origination process and streamline their work. Here’s a closer look at the advantages it provides.

Increased efficiency

Automating the process of assessing assets, income, and employment through AIM reduces manual labor and leads to faster loan closing times. Not to mention, automation through AIM and LPA can reduce cost per loan by cutting out traditional paper-based processes.

With Truework, lenders can automate income and employment verification for all loan applications, not just the ones that may meet Freddie Mac eligibility requirements.

Truework connects lenders to every major income verification method available, including Instant and user-permissioned data. The platform automatically orchestrates each request through the most efficient method based on each applicant’s information.

Higher-quality loans

Freddie Mac’s AIM technology can cut loan defect rates by over 50%, lowering a lender’s risk of the associated financial losses. The average loan defect rate when not using technology in 2023 was 9.7%, while the loans originated with AIM had an average defect rate of 4.5%.

By significantly lowering default rates, the AIM tool helps lenders lower the overall risk of their portfolios, which can lead to more favorable funding and higher credibility with investors.

Better self-employed underwriting

Verifying income and employment for self-employed borrowers, such as freelancers and gig workers, isn’t as simple as checking paystubs or W-2 forms.

With AIM, lenders can use tax data, including returns and transcripts, to evaluate income for borrowers who use IRS Schedule C to take the hassle out of underwriting loans for self-employed individuals.

Borrowers can also link multiple bank accounts, such as checking, savings, and investment accounts, to demonstrate a comprehensive view of their assets and positive cash flow.

The LPA will also analyze the business and income calculation to let you know if the loan is eligible for representation and warranty relief. If you want to have an easier time verifying self-employed income for all of your loans, you can use Truework Credentials to verify income for 1099 workers in minutes.

Improved borrower experience

Allowing for the use of direct-to-source data through AIM means that potential borrowers don’t need to print, send, or email their financial documents as part of the application.

Instead, lenders can offer a more digitized application process where borrowers can seamlessly connect their payroll information or upload employment information online.

From there, the automated income assessment tool streamlines the asset verification process, which helps speed up turnaround times and ultimately creates a more pleasant borrower experience.

Automate income verification for all loans with Truework

Automated income verification and assessment isn’t just helpful for Freddie Mac loans. Lenders can achieve increased efficiency, lower costs, reduced risk, and higher loan turnaround times by automating income and employment verification for all home loans.

Ready to learn more?

Truework is the only platform that automatically orchestrates income verification requests across several methods, ensuring transparency, efficiency, and cost reduction. See the difference and explore Truework today.