5 Ways To Identify Fake Bank Statements on Rental Applications

The rental market has been nothing short of volatile in the past five years. Rents increased by $310 on average, and with sky-high mortgage interest rates, the rental market is more competitive than ever.

In places like New York and California, renters need a minimum salary of $40/hr to afford a two-bedroom apartment. Steep rental prices, coupled with increased demand, may tempt applicants to falsify records so they can stand out among applicants and access listed properties.

While fraudulent rental applications aren’t new, property managers can expect them to snowball in 2024 due to the unfavorable rental market. And when individuals use technology to falsify information on their rental application, the signs of fraud are more difficult for the human eye to identify.

To avoid rental application fraud, property managers must keep up with the latest fraud techniques and modernize their tenant screening process to facilitate fraud detection for their team members.

Here’s a look at the most common signs to spot in fake bank statements for rental applications and how you can improve the fraud detection process with Truework.

4. Odd grammar, dates, names, and addresses

5. Irregular transaction patterns

1. Inconsistent formatting

Inconsistent formatting on bank statements often exposes editing attempts by fraudsters. Elements simply look sloppy or out of place, lacking the consistency you expect from valid financial documents.

For example, a statement may show one font for headers and another for transaction details. Or spacing between entries appears irregular, with some items cramped while other sections look sparse.

These inconsistencies signal someone pieced together fragments from different bank accounts using editing software like Photoshop — rather than official records.

Bank logos and watermarks should also appear seamless, without any size, rotation, or color difference. Fuzzy graphics, mismatched branding, and misplaced icons also point toward tampering.

It requires an eye for detail to catch these discrepancies. But with the advent of new tech backing these fraudulent efforts, current and new team members can easily miss them.

Instead of pressuring their team to develop an eagle eye, property managers can equip their team members with Truework.

Truework Documents gives tenant screeners the tools required to spot small or big formatting inaccuracies quickly, expediting the application process and ensuring bad apples don’t hurt the business’s bottom line.

2. Mismatched totals

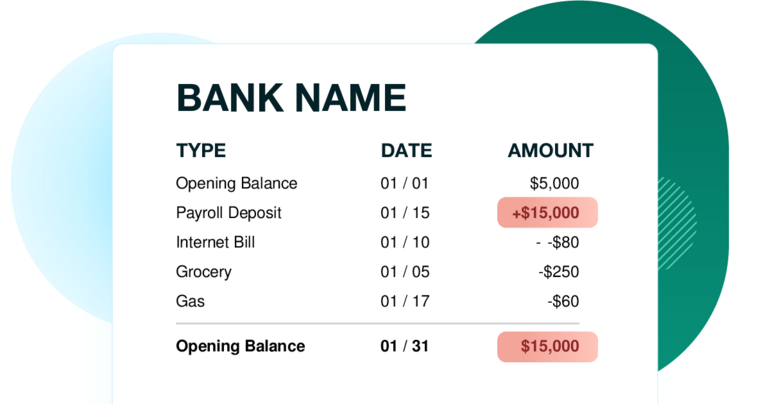

Fraudsters often manipulate bank statements by altering details that don’t align with the opening and closing balances. For example, a falsified statement may list $5,000 as the beginning balance, $15,000 in various deposits and withdrawals over the month, and little activity otherwise.

Yet when totaling the numbers, the statement shows an ending balance of $15,000, which doesn’t add up.

Likewise, small tweaks to individual transactions compound over longer periods, causing noticeable discrepancies. Catching these inaccurate statements manually requires diligence. And the process is often prone to human error.

Truework Documents uses automation to immediately flag statements where financial information may have been altered.

3. Missing key components

Beyond incorrect data, fraudulent bank statements often lack the crucial authentication elements that banks include. Digital signatures, address information, and even entire pages go missing as fraudsters tamper with files.

For example, almost all major financial institutions digitally sign official statements with encrypted certificates validating authenticity. Likewise, vague or missing bank addresses should raise eyebrows. With no branch details, screeners cannot confirm issuing origins. Pages appearing spliced together or truncated also indicate manipulation.

Truework’s Tenant Screening solution performs automatic analysis so staff can prioritize suspicious statements for further fraud investigation rather than just skimming for what’s missing themselves.

Truework’s advanced algorithms check for the presence of official validation marks, address information, and completeness that may be difficult to validate manually. That helps property managers and their teams avoid the time-consuming effort that comes with scrutinizing each and every bank document for hundreds of applicants.

4. Odd grammar, dates, names, and addresses

Along with missing components, inconsistent grammar, dates, names, and addresses often appear in falsified bank statements. Unusual misspellings and formatting applied throughout can indicate amateur editing attempts.

Similarly, names and addresses that don’t match applicant records hint at pieced-together documentation.

For example, a statement may show the applicant’s name as “Jenniffer” instead of Jennifer. Or the bank's address uses unconventional abbreviations like “Frisco, CA,” which isn’t used by legitimate branches.

In addition, transaction dates that are out of sequence or fall on weekends/holidays for deposits raise questions. The small details, such as inconsistent font, round numbers, and typos, can sometimes evade manual screening — especially if they’re practically indistinguishable.

Truework rapidly handles confirmation of key statement elements across applicant records to determine verification accuracy. It prevents otherwise overlooked red flags from enabling falsified financial histories to slip past scrutiny.

5. Irregular transaction patterns

Inconsistent transaction patterns often reveal fake documents and bank statements. Yet confirming legitimacy requires properly understanding applicant earning cycles and common expense cadences.

For salaried workers living paycheck to paycheck, pay stubs should reflect predictable direct deposits aligned to pay schedules. They may withdraw most funds rapidly for rent and then sustain residual amounts until the next cycle.

Moreover, statements from seasonal workers like landscapers demonstrate correlated surges and dips. Summer months show higher activity and revenue inflows compared to winter entries.

However, it may be more difficult to spot fake bank statements with irregular transactions from a freelancer. The nature of the job is varied income, month to month. That said, it’s possible to identify irregular transactions from spending as well as income.

For example, monthly outflows and withdrawals like car payments or grocery spending should demonstrate relative consistency even if earnings rise and fall. Falsified statements often reflect improbable swings across all transaction types — both money flowing in and out.

But something still holds true: The more minute the inconsistencies are, the more difficult they are to catch. That’s why incorporating Truework into the verification process can go a long way to help you avoid the pitfalls of fraud. But more on that below.

How Truework helps property managers deal with fraud

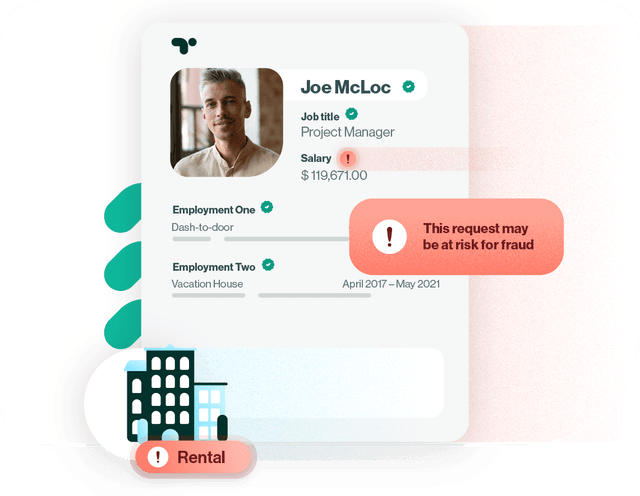

As rental fraudulent applications continue to rise in an uncertain economy, property managers need more than traditional verification methods. They need advanced, automated solutions to provide in-depth defense against sophisticated deception techniques.

That’s why Truework Income offers layered fraud prevention and accelerants to ensure legitimate applicants breeze through while fraudsters are quickly spotted.

By combining income verification from payroll data and documents into a single platform, enterprise portfolios can handle complex tenant screening at scale.

Moreover, with Credentials, Truework taps exclusive partnerships with leading payroll providers to securely transfer accurate payroll data with user consent. By obtaining information directly from payroll providers, lenders can further reduce fraud risks.

In tandem, Truework Documents leverages intelligent automation and machine learning to validate accuracy. Suspicious files and fraudulent documents get flagged for deeper investigation based on anomalies like inconsistent formatting or transactions not reconciling.

In an increasingly risky rental market, Truework improves efficiency while providing peace of mind to property managers.

Spot income fraud upfront with Truework

Manual review alone cannot keep pace with increasingly sophisticated falsification attempts. Leveraging Truework Income for Tenant Screening streamlines the process by taking human error out of the equation — ensuring your risks are minimized.

By allowing applicants to securely share payroll data directly while cross-checking numbers and formats for tampering, Truework helps property managers identify fake bank statements for rental applications and reduce the risk of fraud.

Ready to learn more?

Rather than playing catch up once fraudulent tenants take residence, get ahead of deception from initial outreach. Contact us to turn the tide against sophisticated rental application fraud through cutting-edge accuracy and speed.