How to ensure fair tenant screening with automated VOI/E solutions

Tools like automated income and employment verification software, which leverage artificial intelligence and algorithm-based decision-making, can help property managers and tenant screeners work more efficiently.

They eliminate manual processes, support better lending decisions, improve turnaround times, and create a more pleasant applicant experience.

That said, if you’re not monitoring the software you use and following best practices for fair and accurate screening, you can open yourself up to issues of bias and discrimination.

For property managers, it’s crucial to understand how solutions like algorithm-based tenant screening tools can increase the risk of discrimination in decision-making and get in the way of fair housing and fair tenant screening compliance regulations.

Let’s take a closer look at the laws around tenant screening and how to ensure compliance when using algorithm-based solutions in the rental application process.

What are fair tenant screening laws?

Fair tenant screening laws are regulations designed to promote housing access and protect applicants and renters. They ensure landlords screen tenants in a transparent and non-discriminatory way.

Moreover, managers responsible for screening potential tenants must understand the federal and state regulations that apply to their rental properties.

The Fair Housing Act (FHA) and federal fair tenant screening regulations

The Fair Housing Act (FHA) is a federal law that makes housing discrimination illegal in the private and public sectors. Specifically, the FHA prevents landlords and rental property owners from discriminating against potential tenants based on the following characteristics:

- Race

- Color

- Religion

- Familial status

- Mental/physical disability

- National origin/ethnic background

- Gender identity and sexual orientation

These groups are often referred to as the seven federally protected classes. The FHA outlines several discriminatory practices landlords cannot take based on these classes, such as denying housing or evicting tenants.

When it comes to tenant screening in particular, it’s illegal, per FHA guidelines, to set different qualifications, criteria, or application requirements for tenants based on race, color, religion, sex, familial status, disability, or national origin.

Examples of ways that landlords can violate the FHA during the advertising and screening process include:

- Requiring a higher security deposit from a specific class, such as families with children.

- Advertising for or against a certain type of tenant, such as describing a property as families only.

- Including questions on your application that refer to a tenant’s religious beliefs, familial status, race, or disability.

- Setting higher standards for one group of renters, such as requiring a higher credit score for Black or Latino tenants.

The FHA is enforced by the Department of Housing and Urban Development (HUD), which handles complaints and conducts investigations when an applicant or tenant reports alleged discrimination. Consequences of illegal discrimination under the FHA can include:

- Compensating the tenant for their expenses, including legal fees.

- Providing equitable relief, usually by making the housing available to the individual or family.

- FHA civil penalties ranging from $25,597 for first violations to $127,983 for those with two or more existing violations in the past seven years.

As such, it’s essential for landlords and property managers to create nondiscriminatory tenant screening processes. This includes ensuring that all technology you use during the application process complies with regulations like the FHA.

State housing and tenant screening laws

In addition to the federal laws, some states, like Washington, have their own fair housing laws or tenant screening acts.

The state of Washington, for instance, goes beyond anti-discrimination to outline rules for fair tenant screening. Specifically, Washington requires that screeners notify prospective tenants before they obtain information, explaining what information will be obtained and what criteria can be used to deny the application.

Moreover, if landlords take adverse action (such as denying tenancy) based on a tenant screening report, they are required to give the applicant written notice that includes the contact information of the consumer reporting agency that generated the report. This gives applicants the opportunity to obtain a copy of the report and dispute any inaccuracies.

Non-compliance can lead to fines at the state level, and the potential for criminal charges depending on the unique situation. Beyond that, discrimination charges can lead to reputational damage for rental properties, making it difficult to find new tenants.

For landlords and property managers, it’s key to understand federal and state fair housing and tenant screening laws because even accidental/unintentional discrimination leads to non-compliance.

Algorithm-based tenant screening and discrimination

As automated screening tools become more popular among property management companies, there’s been debate about who’s liable for discrimination resulting from using algorithm-based screening platforms.

In January of 2023, The Department of Justice and the Department of Housing and Urban Development clarified how the FHA applies to algorithm-based screening tools.

According to Assistant Attorney General Kristen Clarke, landlords, property management companies, and tenant screening companies that use automated and algorithm-based tools to make application decisions are “not absolved from liability when their practices disproportionately deny people of color access to fair housing opportunities.”

In other words, property managers can be held liable if someone files a claim saying they violated FHA and it’s found to be true. Protected classes can also file a lawsuit for damages.

Ultimately, property managers are not exempt from the FHA’s regulations if they use an algorithm to make decisions. So, for those planning to implement algorithm-based or AI-supported tools in their application and screening process, there are two key factors to consider.

First, while algorithms help streamline tenant screening, they are developed by humans and are inherently susceptible to the biases (conscious or not) of those who create them.

Second, algorithm-based tools have the potential for lack of transparency if they are used to approve or deny applications without having them “show their work.” This may increase the risk of violating fair tenant screening laws because property managers cannot supervise the software’s decisions and ensure that they are not discriminating against any protected classes.

That said, this doesn’t mean tenant screeners should entirely shy away from algorithmic tools and AI software or avoid screening services that rely on them. The key is to take a thoughtful approach that minimizes the risk of discriminatory practices while getting the benefits of automation, algorithms, and AI.

Best practices for ensuring fair tenant screening with your automated income verification solution

When implemented thoughtfully, technologies such as automated income verification platforms have the potential to enable efficiency in the application process while ensuring fair tenant screening practices.

Create a transparent screening process

Transparency is a crucial element of fair tenant screening as it promotes accountability within teams and trust with applicants. Clarity in the application process means landlords and tenant screeners need to be able to answer for their decision-making and provide nondiscriminatory reasoning for each choice.

When it comes to transparency with applicants, they should know what screening criteria is collected and used when making a decision. Providing this insight to potential tenants means they’ll likely see the application as objective and fair.

Regulate and limit the screening data

For property managers who want to stay on the safe side of FHA and state housing law compliance, it’s best to limit the application and screening process strictly to the data that will help them determine whether the applicant can reliably pay rent on time.

This includes rental history and eviction history, which property managers can get from interviewing previous landlords or through tenant background checks from screening companies. Property managers also want to know a tenant’s income and employment status, which they can get using VOI/E software.

They should exclude questions used to determine whether someone is in one of the classes protected by the FHA. Examples include questions about race, ethnicity, religion, and familial status. By not collecting data that identifies someone as a member of a protected class, tenant screeners will be less likely to let those factors influence their decisions.

Apply the same criteria to each applicant

To ensure fair tenant screening, property managers want to hold each applicant to the same standards, such as minimum monthly income or minimum credit score.

Automated income verification and employment can come in handy here as it creates a streamlined and repeatable process that they can use for each applicant.

How to find tenant-screening tools and services that support fair housing

Since landlords can be held liable for the actions and decisions of algorithm-based tools, it’s crucial to find the right tenant screening services or software. Here are some qualities that will help ensure property managers stay on the right side of fair housing compliance while improving the accuracy and efficiency of their screening process.

Thoughtful approach to algorithmic decision-making

Algorithms and AI provide the most benefits when used as tools that support teams rather than replace them. When it comes to tenant screening, it’s best to avoid using solutions that make decisions without any supervision.

Instead, it’s helpful to leverage software that automates data collection, which speeds up the process and reduces mistakes caused by manual data entry. This gives screeners faster access to higher-quality data, allowing for faster turnaround times and better decision-making.

As tools continue to develop, property managers can benefit from AI-based recommendations on a tenant screening report. Still, we recommend using providers that foster transparency by showing which data and logic it used to arrive at its decision. Then, the team can review the reasoning to ensure no discriminatory practices are happening in the software.

Access to source data

Source data provides property managers with accurate and objective financial information they can use to figure out which applicants can be expected to reliably make their rent payments on time.

That’s why it’s useful to use tools with access to user-permissioned data, which are often used for automated income and employment verification. These solutions let applicants consent to share data directly from a third party, such as a payroll provider.

This way, property managers and landlords can rely more on the accuracy of the income information they receive to make decisions rather than subjective application questions.

Automated fraud detection

In addition to accessing source data, property managers can increase the accuracy of their income data by leveraging software with fraud detection tools for applicants who upload documents (e.g., pay stubs or tax filings).

This ensures they keep the risk of income fraud low while only using information that complies with fair tenant screening requirements.

High-coverage verifications

As more people opt for non-traditional careers, such as freelancing, self-employment, and gig work, it can be challenging for property managers to compare these applicants with salaried workers objectively.

When looking at solutions like automated VOI/E, property managers should look for providers that offer high coverage and tools to analyze income for potential tenants that have less predictable earnings.

FCRA compliance

Like the FHA, the Fair Credit Reporting Act (FCRA) aims to protect consumer rights by regulating how consumer credit checks can be used for application decisions, including tenant screening.

Providers that comply with the FCRA are committed to fair consumer treatment, information accuracy, and transparency.

Final thoughts: Ensuring fair tenant screening with automated VOI/E

AI and algorithm-based tenant screening tools are excellent ways to streamline the application process, increase turnaround times, and provide better applicant experiences.

But they aren’t perfect. As property managers continue to incorporate tools based on algorithms and artificial intelligence, it’s crucial to be aware of the risk of discriminatory practices and take steps to prevent them.

With the right strategy in place, tools like automated VOI/E can help property managers create a more equitable process that supports fair housing efforts while minimizing the risk of income fraud and lowering the possibility of evictions.

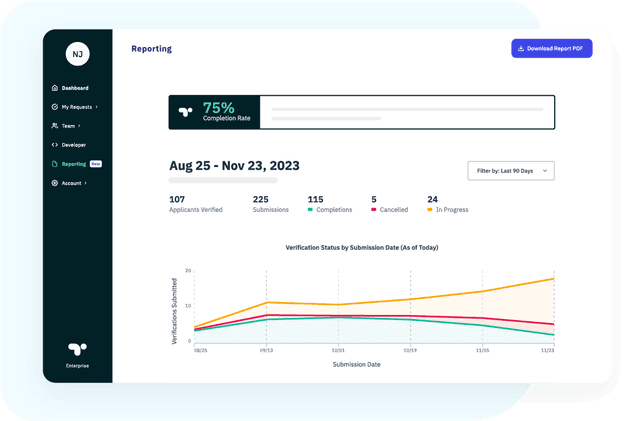

With Truework, income verification requests are automatically orchestrated across various methods to maximize efficiency while giving property managers access to accurate information.

Ready to learn more?

Uplevel your tenant screening with automated income and employment screening.