Multifamily housing trends to watch out for in 2024

After experiencing high growth rates of 12.9% in 2021 and 10.1% in 2022, the U.S. multifamily rental market experienced a slow period throughout 2023, with a rent decline of 1.7%.

The demand-supply imbalance due to 439,394 new units delivered in 2023 caused a year-over-year change of -0.9%, ending last year with an occupancy rate of 94.2%.

Given these existing strong headwinds, property managers must prepare themselves for the upcoming market changes to keep their businesses sustainable in the long term.

Let’s look at the top marketing trends that will affect the multifamily housing market in 2024.

Multifamily housing market trends

While higher construction of multifamily rental units is the major factor affecting the multifamily market, property managers will also experience a change in tenant preferences with increasing Gen Z renters, widespread work-from-home gigs, and preference for sustainable housing.

1. Historic boom in multifamily construction

The demand-supply imbalance that affected 2023 will become even worse in 2024. RealPage, a leading provider of property management software, expects over 670,000 new housing units to become available this year.

As the largest increase in multifamily properties since the 1970s, it’ll decrease the occupancy rate even further, making the rental market even more competitive for property management companies.

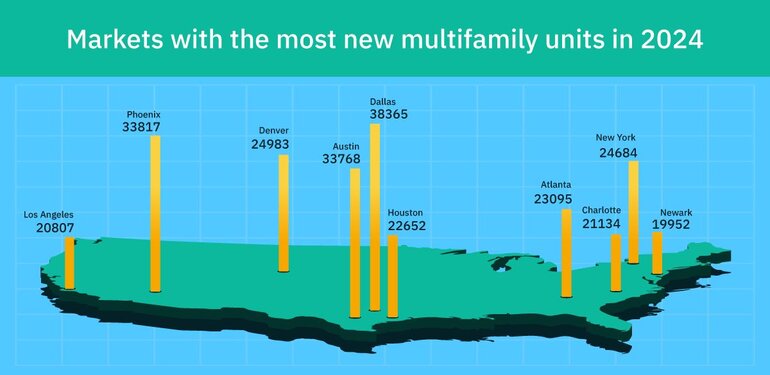

That said, the results from the new influx of housing units will vary from region to region. In the U.S., the South will experience the most impact — with 53% of new apartment units scheduled in that region.

In particular, Dallas, Austin, Atlanta, Houston, and Charlotte are expected to get more than 20,000 new rental units in 2024.

While the Southern markets are receiving most of the new housing deliveries, markets in the Western region aren’t far behind, with 27% of the new apartment deliveries heading that way. Phoenix, Denver, and Los Angeles, for instance, will get an increase of over 20,000 new units in their multifamily housing inventory.

With only 20% of the national supply heading to the Northeast and the Midwest, the effects of this higher supply will be comparatively lighter in those regions. Still, the competition can be higher for property managers in New York and Newark, which are also expecting around 20,000 new units in 2024.

While this increased supply of housing units increases competition, it also opens opportunities for property owners with efficient operations.

Martin Orefice, CEO of Rent To Own Labs, shares that “there’s room for profit at slightly thinner margins since high interest rates and limited construction of starter homes have kept the demand for rental units high.”

2. Below-average rental growth

While the risk of recession in the U.S. seems to be fading, Fannie Mae expects a below-average rental growth of 1-1.5% due to the demand-supply gap causing a high multifamily vacancy rate.

That said, markets in different regions might experience better or worse rent growth. For instance, RealPage expects the Midwest markets to have a rental growth of up to 3% due to lower supply. In contrast, it expects the markets in the North and South regions to have a rent growth of less than 1%.

In particular, markets with high supply compared to demand might experience negative rent growth. Austin and Phoenix, for instance, experienced a rent cut of 6% and 4.3% in 2023.

On the flip side, competitive markets might still show strength amidst increased supply. For example, New York’s rents increased by 2.1% despite the apartment supply being higher than its demand.

Still, with the resumption of student loan payments in Q4 of 2023, renters will have even less room in their wallets for rental payments in 2024. So, property managers will need to work on reducing their operational costs to attract budget-constrained tenants.

3. Hybrid work is affecting decisions in multifamily housing

Many of the pandemic changes are here to stay. According to a 2024 survey by the National Multifamily Housing Council, 52% of the respondents still work from home.

As a result, property managers also need to work toward upgrading their housing units with digital amenities to attract tenants looking for a supportive rental place. In particular, property managers can equip their multifamily units with high-speed internet, dedicated work areas, and home office spaces.

Additionally, property managers may also benefit from fewer vacancies by improving their digital setup.

Sara Levy-Lambert, head of operations at Awning, shares that “upgrading internet infrastructure helped increase our appeal to younger renters who work remotely or prefer digital conveniences, increasing our retention rates.”

While adding dedicated spaces for hybrid work might be a great idea for the long term, property managers should start looking into offering community Wi-Fi since 79% of renters prefer an apartment with seamless Wi-Fi.

4. Streamlined property technology is becoming essential

Beyond the high multifamily vacancy rate, property managers also have to make do with evictions eating into their profits. According to data from Eviction Labs, 8 out of every 100 rented households had at least one eviction in the last 12 months.

With eviction expenses reaching up to $10,000 in lost rent, legal fees, and maintenance costs, property managers have started adopting property technology to identify qualified tenants from the pool of applicants.

That said, with 33% of renters applying to more than one rental unit during their search, a property technology solution that takes weeks to vet tenants isn’t enough. Instead, property managers need tools that help them minimize screening time so they can approach applicants before the competitors.

Truework Income for Tenant Screening unifies multiple verification channels to help property managers verify proof of income of 90% of candidates within 72 hours, helping them access a pool of ideal tenants.

5. Long-term rentals are gaining popularity over homeownership

Interest rate hikes have pushed homeownership out of the reach of millions of renters. At the year-end of 2023, average mortgage payments were 38% higher than average rent.

As a result, many renters are increasingly pessimistic about ever being able to buy their own home. According to a 2023 Fannie Mae study, 46% of permanent renters are renting because of decreasing housing affordability, up from 40% in 2021.

Since these people are looking for a long-term rental, they typically place a high value on living in a safe community (72%), near work (45%), and in the proximity of restaurants, shopping areas, and entertainment hubs (43%).

Since these renters prioritize safety, property managers can work on improving the tenants they accept in their community. For instance, they can screen the rental applications more thoroughly to accept high-value tenants.

6. Renters are going green

The 2024 survey by the National Multifamily Housing Council also states that 42% of renters are expecting to purchase or lease an electric or plug-in hybrid vehicle in the next two years. For property managers competing for tenants due to high supply, an electric charger in the multifamily community can be a great amenity to attract environmentally-conscious renters.

That said, while environmental impact plays a factor, the cost-benefit of sustainable energy sources also attracts tenants.

Scott Sloan, founder of Grand Exit Property Acquisition Group, shares that he’s specifically “observed a growing demand for eco-friendly features such as energy-efficient appliances among tenants.”

Data backs it up, as well, since the 2023 Fannie Mae study also found that high utility costs due to inefficient appliances remain a major challenge for 22% of renters.

7. Demographic shifts are dictating preferences

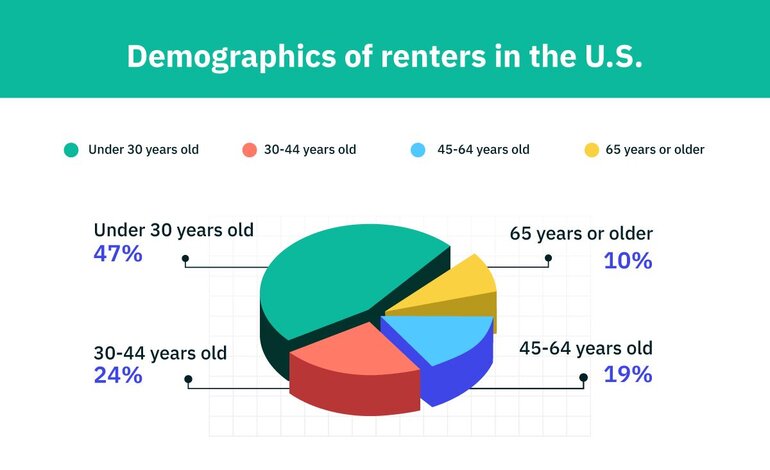

According to the National Multifamily Housing Council, almost 70% of renters are less than 45 years old — with 50% being less than 30. In other words, it’s mostly Gen Z (aged 12-27 in 2024) and Millennials (aged 28-43 in 2024) driving rental demand, with Millenials transitioning to single-family homes.

With this change in demographics, the preferences that influence property management strategies have changed, too. Levy-Lambert mentions that “Millennials and Gen Z, who now constitute the majority of our rental clients, show a strong inclination towards properties that offer not just a place to live but a lifestyle.”

Levy-Lambert recommends that property management companies focus on providing “amenities like high-speed internet, eco-friendly features, and communal spaces that foster social interactions” to attract modern tenants.

Gen Z, in particular, strongly prefers sustainable rentals. For instance, a 2023 report on Gen Z students showed that 80% of them considered sustainability a major factor in deciding where to live.

While investing in sustainable options might appear overwhelming, a 2023 RealPage report found that Gen Z tenants are also willing to pay more rent for housing units with sustainability initiatives.

8. Multifamily housing is going smart

Smart technology is becoming a popular perk among renters — especially among high-income residents. Recent research showed that about 50% of renters with a monthly housing budget of over $2,000 want smart technology in their dwellings.

To stand out from the competition, property management companies can consider adding smart electronic locks for convenience and smart doorbell cameras to check who’s at the door. While this might appear to be a minor improvement, it can greatly improve the rental value of upper-floor housing.

9. The Sun Belt is having a strong showing

While demand-supply imbalance affects most of the popular metro cities, several Sun Belt cities, such as Dallas, San Diego, and Tampa-St. Petersburg, are expected to experience high rent growth rates, according to Marcus & Millichap.

- Dallas: Although Dallas will welcome more than 30,000 new housing units in 2024, the expected rent growth is 2.9% due to strong rental demand driven by an increase in available jobs.

- San Diego: With a below-average housing supply of 2,850, gradual job growth of 0.7%, and one of the lowest vacancy rates (4.2%) among prominent U.S. rental markets, San Diego expects a rent growth of 3.5%.

- Tampa-St. Petersburg: While it expects new deliveries of 7,900 units in 2024, the growing job market and the inflow of new residents are expected to help the demand almost balance the housing supply. As a result, expected rent growth is 3.2%.

Keeping pace with multifamily housing trends

With these trends changing the rental market landscape, property managers need to evolve as well instead of relying on tried-and-tested strategies.

And it doesn’t have to be a major investment. Rather, property managers can take gradual steps by incorporating property technology in their processes to facilitate both renters and leasing teams.

Ready to learn more?

Truework Income helps leasing teams speed up tenant screening to get qualified tenants without skipping any steps.