How lenders benefit from working with Fannie Mae Day 1 Certainty vendors like Truework

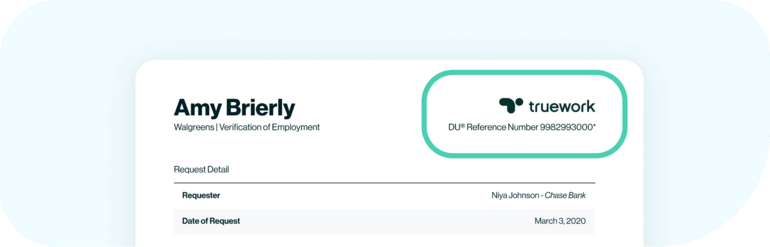

Truework offers lenders Fannie Mae Day 1 Certainty as an authorized report supplier for income and employment verification through Desktop Underwriter® (DU®). All reports eligible for Day 1 Certainty will have a DU Reference number in the top right corner of each report.

Requests verified through Truework’s network of over 100 million employee records are D1C eligible. Requests verified through several of our third-party providers may also be eligible.

What are Day 1 Certainty approved vendors?

Fannie Mae Day 1 Certainty and the Desktop Underwriter® (DU®) streamline lending by providing lenders with an automated digital loan origination tool that reduces manual processes and ensures quicker turnaround times.

Specifically, D1C-approved providers are third-party data vendors certified to validate applicant information, like employment and income, for D1C-eligible loans.

There are three types of authorized report suppliers:

- Verification of income and employment

- Tax transcript reports

- Asset verification

Certified verification solutions, like Truework, have been approved by Fannie Mae to provide high-quality reports for the Desktop Underwriter® tool. Eligible verifications typically contain a DU® reference number, which can be sent electronically to the Desktop Underwriter®.

Benefits of working with Day 1 Certainty approved vendors

Working with D1C-approved third-party data providers allows lenders to operate more efficiently and create a better user experience while receiving the benefits of Fannie Mae Day 1 Certainty.

Here’s a look at the advantages lenders get by streamlining mortgage applications and loan origination processes when using vendors that have achieved Day 1 Certainty:

- Less paperwork: Automated digital verification means lenders need to collect less paperwork from borrowers, resulting in more efficiency in loan origination.

- Faster loan turnaround times: Lenders can reduce cycle times by up to 12 days when employment and income are validated at the loan level through Fannie Mae’s DU® validation service. Vendors like Truework give lenders access to D1C-approved verifications in seconds or minutes rather than days and weeks.

- Improved borrower experience: Leveraging digital tools to reduce friction in the application process and ensure quicker turnaround times creates a better borrower experience that reduces loan fallout.

- Lower risk of loan buybacks: By using Truework and the DU® validation service, lenders can receive freedom from reps and warrants on eligible income and employment validation reports.

Why lenders should choose Truework to support their DU validation service

By orchestrating income verification requests across multiple methods, Truework provides lenders with a simplified VOI/E process that improves turnaround times, reduces costs, and works seamlessly with Fannie Mae’s Desktop Underwriter® validation service.

High D1C coverage

With Truework, mortgage lenders can access all the major verification methods, including Instant, Credentials, Documents, and Smart Outreach.

Requests completed through Truework Instant and Credentials are now eligible for D1C, giving lenders access to 100 million D1C income and employment records through a single verification platform.

Quicker processing times

Truework automatically orchestrates each request using the fastest method based on the applicant’s information. In particular, Truework Instant provides verification in seconds for 48 million employee records, and Truework Credentials offers verification in minutes by leveraging user-permissioned data.

Transparent pricing

Lenders get full transparency into each request and only pay for complete and accurate verifications, not each request. Through smart orchestration across various methods, Truework eliminates duplicate verifications and their unnecessary costs.

User-friendly verifications

Truework automatically determines whether each request is D1C eligible after lenders submit them. There is no need to request D1C checks or change settings.

Lenders can easily identify D1C-eligible reports in their Truework Dashboard or by looking for the DU Reference Number on individual income and employment verification reports.

Lenders can access more Day 1 Certainty verifications with Truework

Fannie Mae Day 1 Certainty helps lenders create a competitive advantage by enabling more digital application capabilities and reducing paperwork. D1C also reassures lenders about the quality of each loan and provides relief from representation and warranty obligations on certain loan components.

Ready to learn more?

Take advantage of all the benefits of Fannie Mae Day 1 Certainty with Truework's automated income and verification reports. Learn more about Truework’s one-stop income verification platform today.