Guide to Day 1 Certainty for digital mortgages

With the mortgage industry facing extreme financial pressures — high home prices, increasing inflation, and tight housing inventory — reducing costs has remained the top business priority for mortgage lenders for two consecutive years.

That said, many lenders haven’t had much success in cutting down their costs. A Wolters Kluwer study found that the average mortgage lender lost $1,972 per loan in the first quarter of 2023, with staffing being the most significant factor. That means the more lenders can leverage technology instead of labor, the more they save on expenses.

This guide will explain how lenders can automate the busywork via Day 1 Certainty from Fannie Mae to improve their profit margins.

What is Day 1 Certainty?

Day 1 Certainty (D1C) is a Fannie Mae Desktop Underwriter (DU) validation service for lenders to verify income, employment, and assets and appraise property. Specifically, it cross-checks third-party validation reports of borrower information, providing a high degree of confidence right at the beginning of the loan process — hence “Day 1.”

Introduced to streamline the mortgage lending process by providing lenders with efficient verification in the underwriting and approval process, D1C lets lenders access automation tools to expedite the mortgage origination process, providing lenders with certain assurances regarding the accuracy of borrower information.

How Day 1 Certainty improves mortgage lending

D1C enhances mortgage lending by promoting speed, accuracy, and cost-effectiveness in the underwriting process while also making the lending process streamlined for borrowers.

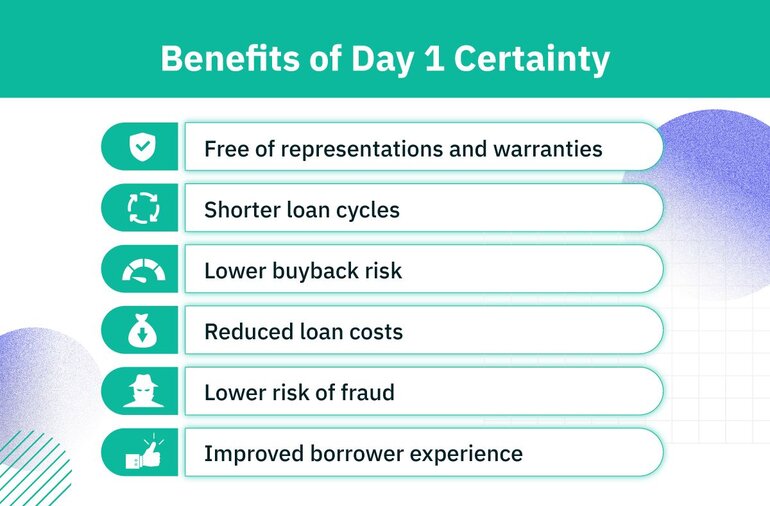

- Free of representations and warranties: If a lender verifies the income, employment, and assets via DU validation service, Fannie Mae won’t enforce representations and warranties related to misstatements, misrepresentations, and inaccuracies in loan delivery data found down the line.

- Shorter loan cycles: Without the typical paperwork (e.g., pay stubs, bank statements, and asset account details) complicating the loan cycle, the process goes much faster. In fact, according to Fannie Mae’s data, lenders have seen their loan cycle cut by 12 days with automated income and employment verification. Some approval times even go down to eight days with asset validation. In contrast, without using the DU, several lenders experienced loan cycle times of 40 to 45 days.

- Lower buyback risk: Since D1C offers relief from representations and warranties related to incorrect borrower information, lenders have a lower risk of having to buy back loans if a defect gets discovered in the lending process.

- Reduced loan costs: By adopting digital-first methods for loan approval, lenders can avoid the common time sinks associated with high loan costs. In fact, a Fannie Mae survey found technology investments to be the top cost-decrease drivers for loans.

- Lower risk of fraud: D1C lets lenders access vetted tools from approved vendors to verify the authenticity of financial information from borrowers, freeing loan officers from manually sifting through mortgage applications.

- Improved borrower experience: With D1C, borrowers can consent to have their financial information validated by electronic means. As a result, borrowers don’t have to free up time slots for mailing, faxing, or visiting in person to submit documents.

How to obtain Day 1 Certainty approval for a mortgage loan

Lenders need to follow the steps below to get a D1C for a loan application.

1. Get borrower consent to pull electronic

data To start, lenders need to obtain explicit consent from borrowers before accessing and using their financial information. Borrower consent is a legal requirement to comply with relevant privacy and data protection laws — such as Fair Credit Reporting Act (FCRA).

Without borrower consent, a lender won’t be able to feed the financial details into the DU.

2. Order report from approved vendor(s)

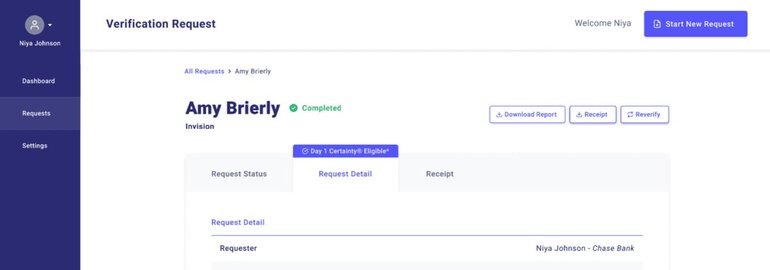

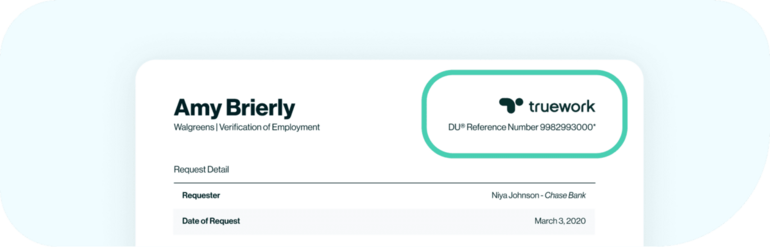

After getting consent from a borrower, lenders can verify the financial information they submitted via Fannie Mae’s approved vendors like Truework, the first income and employment verification provider approved by Fannie Mae.

Truework lets lenders instantly verify the proof of income of borrowers via its network of 48 million active employees. Plus, it also has access to a range of third-party verification provider partners. If Truework finds the borrower’s data via one of these verification methods, it flags a request as D1C-eligible.

In addition, lenders can find the DU reference number for the loan application at the top of the employment verification report, as shown below.

3. Enter information into the DU and submit case file

Lenders input borrower information into the DU, such as the borrower’s name, Social Security number, income, employment history, and other financial information. After entering all the required borrower information, lenders can submit the case file for review.

4. Wait for Fannie Mae’s DU to validate the information

After going through the application, Fannie Mae returns its decision, which can be:

- Validated: The DU considers the verification report to be acceptable documentation for D1C.

- Not validated: The DU service has found that the verification report doesn’t fully support the borrower details the lender entered into the DU. As a result, it’ll specify the additional documentation required to validate the application.

- Unable to be validated: The DU couldn’t access the verification report data or find it sufficient to validate the borrower details. In that case, it’ll ask for additional or alternative documentation.

With Truework, lenders can expect 40% of income verifications to be D1C-eligible since it has access to over 100 million income and employment records. Its quality assurance process also ensures successful validations with less than a 1% error rate.

5. Close the loan, deliver it to Fannie Mae, and get Day 1 Certainty

If a particular loan is D1C-eligible, lenders can sign the loan documents, disburse funds, and sell the loan to Fannie Mae. Plus, they obtain the D1C benefits, such as relief from reps and warranties.

Use Truework to effortlessly verify loan applications

While Fannie’s Day 1 Certainty helps expedite the loan application process, lenders may still struggle with technology bottlenecks if their verification providers rely on dated verification methods. Or they may have to waive D1C eligibility due to a lack of supporting data.

Ready to learn more?

Truework offers Day 1 Certainty elgibility on over 40% of completed income verifications.