Tenant screening solutions: How to evaluate income verification platforms

As the world steps into 2024, property managers will face unprecedented levels of competition in the rental market. A 2024 CBRE report expects 440,000 new rental units in the new year, raising the overall vacancy rate to 5.3% (above the pre-pandemic average of 4.7%). As a result, CBRE expects rent growth to slow down to 1.2% in 2024.

To survive these headwinds, property managers must look for ways to maximize revenue and reduce operating costs. That includes weeding out process inefficiencies to avoid losses that slip through the cracks.

Among those inefficiencies, rental application fraud has become more prominent lately. The National Multifamily Housing Council's 2024 survey of property owners found that 84.3% of respondents have encountered rental applicants with fraudulent pay stubs, employment references, or other income documentation in the last 12 months.

With inaccurate income data in their systems, property managers approve many tenants who don’t pay their rent on time — in fact, 20% of tenants don’t make timely payments. As a result, property managers have to evict those tenants sooner or later, leading to eviction costs, lost rent, and higher vacancy rates.

To avoid these issues, property managers should consider using an income verification platform that accelerates tenant screening and identifies fraudulent applications.

This guide explores the key details property managers should know when incorporating an income verification platform into their tenant screening process.

Who is this guide for?

Operations executives who want to reduce instances of income fraud in their portfolio, minimize late payments and evictions, and make net operating income more predictable.

Leasing teams who want to reduce the time spent reviewing income documentation for legitimacy.

Why is an income verification platform important?

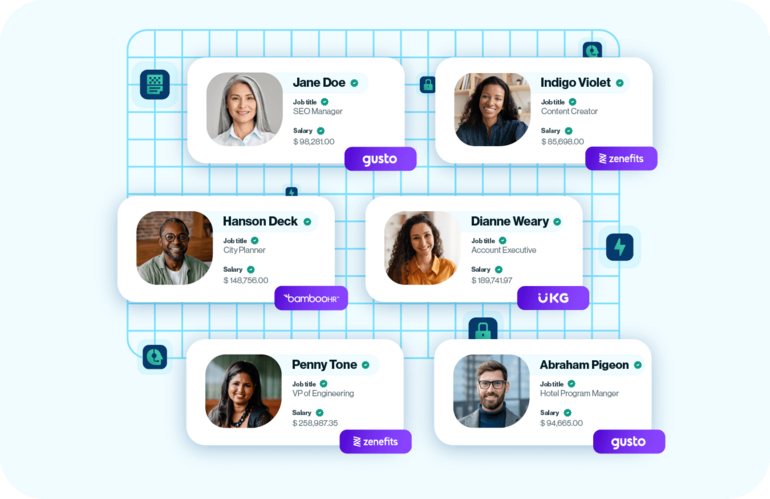

An income verification platform for tenant screening is a digital solution that enables property managers and rental operators to verify prospective tenants' monthly income and financial stability. It automates the process of collecting and verifying proof of income to ensure the tenant's ability to meet their financial obligations, particularly rent payments.

Besides assisting property managers in verifying income details, tenant income verification platforms help them comply with the Fair Housing Act, which prohibits any bias in tenant selection based on race, color, religion, sex, disability, familial status, and national origin.

Since income verification platforms use standardized income verification methods, property managers and rental operators can showcase that their tenant selection process is fair and unbiased. This helps prevent potential discrimination claims based on race or other protected characteristics, promoting equal opportunity for all prospective tenants.

Benefits of an income verification platform

Adopting a tenant income verification platform also offers benefits such as fewer evictions, quicker applications, and higher productivity.

Fewer evictions and delinquencies due to income fraud

In 2023, the eviction filing rate across the 10 states Eviction Labs tracks was 8%. In other words, 8 in 100 rented households had at least one eviction in 2023.

In addition, property managers in the National Multifamily Housing Council’s survey shared that 23.8% of their eviction filings were due to income fraud on rental applications. After being approved based on fraudulent data, renters could not pay their monthly rent.

Dealing with eviction isn’t easy. On average, property managers can expect to lose up to $10,000 in legal fees, lost rent, and repair expenses.

By using a tenant income verification platform that verifies candidates’ source of income independent of their rental applications, property managers can greatly reduce their eviction losses, improving their operational efficiency.

Faster and safer application cycles

While eviction costs can add up quickly, the cost of vacant properties and applicant drop-off due to long application cycles can hurt the business’s bottom line just as much.

That said, property managers must balance ensuring they don’t let the bad apples in and offering a smooth and timely application process that results in a good experience for prospective tenants.

A tenant income verification platform ensures faster approvals don't come at the cost of increased fraudulent applications. Since the process is automated, property management companies can serve potential tenants without long wait times.

Increased focus on higher-value tasks

A tenant income verification platform enables the leasing staff to automate the verification process. Instead of spending time on paperwork, phone calls, and email exchanges with tenants and employers, they can spend time on value-generating tasks.

For instance, leasing staff can build relationships with tenants by offering personalized assistance, addressing tenant concerns, and fostering positive interactions.

While that’s a great benefit in itself, it also helps property owners increase their tenant retention — 2023 AppFolio research showed that 45% of dissatisfied renters who moved to a different rental were seeking better property management.

Faster staff ramp-up time

With a tenant income verification platform, property managers and rental operators can onboard new leasing team members in less time. Due to standardized processes, streamlined communication, and reduced manual work, they have plenty of safe space to get accustomed to the company's processes.

For example, since an income verification platform relies on built-in messaging systems, it doesn’t hinder new staff members from contacting tenants and employers for clarification, saving them from setting up separate business communications from scratch.

Beyond that, the predefined workflows and processes for income verification let newcomers avoid reinventing the wheel. Instead, they can learn the standardized processes and focus on needle-moving tasks.

Reduced vacancy periods

A rental income verification platform helps property management companies reduce vacancy periods by expediting tenant screening, filtering out fraudulent applications, and increasing their competitive advantage.

The American Housing Survey (AHS) shares that 33% of renters apply to more than one housing unit. With an income verification platform, property managers can respond to those applications before competitors and have a larger pool of qualified tenants.

If property managers use multiple independent verification methods in the workplace, their leasing staff will have to input tenant details into more than one platform to verify the applicant’s income — doubling or tripling their manual work.

To streamline this process, property managers must combine several verification tools and technologies to automate as many verifications as possible using one touchpoint. It’ll help reduce operating costs and minimize the number of tools and processes the leasing team must manage to verify the proof of income.

Multiple options for applicants

Rental income verification platforms should help property management companies filter the applications without causing applicant drop-offs.

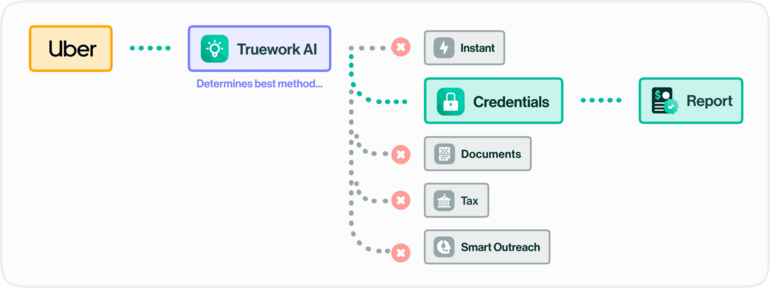

For instance, if an Uber staff member applies for a rental unit, they shouldn’t have to share a 1099-K that only an Uber driver could provide. Instead, the income verification platform should support multiple options for candidates depending on their job situation — full-time employee or gig worker.

Common options the platform should support include instant verification from company records, logging into payroll or bank accounts, and parsing income documents.

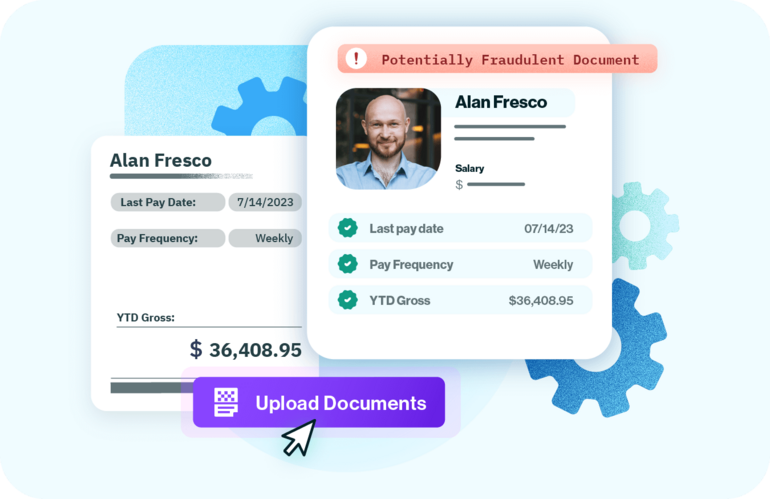

Document fraud detection and recommendations

Document fraud is fairly mainstream, with 1 in 8 rental applications fraudulently altered.

With social media, it has become easy to acquire fraudulent templates. Inscribe’s 2024 report shared that unique fake templates increased by 20% in 2023 — with an increase of 69% in fake bank statements and a rise of 512% in fake pay stubs.

The income verification platform should also have an integrated document parsing tool to scan through metadata, look for discrepancies, and turn the text into a structured form for easier data collection.

AI to increase speed

With the diverse range of renter applications a large property management company receives, trying each verification method one by one isn’t the most optimal solution. Instead, to expedite the application process, the income verification platform should have AI capabilities to handle the routing tasks.

After all, leasing staff shouldn’t have to manually verify the income of tenants working at companies with corporate hierarchies. Instead, the verification platform should automatically identify the appropriate legal entity to verify the annual income.

Last but not least, if all the instant verification methods fail, property managers should have AI to fall back on for approaching the applicant’s employers via their contact information. In short, the verification platform should adopt AI wherever possible to reduce the time it takes to verify proof of income documents to minimize vacancy periods.

FCRA compliance

While income verification platforms offer instant verification methods to expedite tenant screening, they might report incorrect income information if outdated databases, system glitches, or incomplete data exist.

To build trust with the tenants in such cases, property managers should opt for an income verification platform certified as a Consumer Reporting Agency (CRA) that complies with the Fair Credit Reporting Act (FCRA) to enable applicants to easily dispute their current income information.

Reporting to quantify impact and refine strategy

Lastly, income verification platforms should also support reports and analytics, allowing property managers to gain full visibility into the leasing team’s performance.

For instance, property managers must be able to track metrics like completion time and turnaround time to gauge how long it takes to verify a tenant’s employment. They might also benefit from viewing the success rates of different verification methods to further optimize that part of the tenant screening process.

Property managers should obtain the granular details they need to quantify the impact of the income verification platform and refine their verification strategy.

Questions to ask an income screening provider

- How many of your verification methods use direct-to-source data

- What is the average completion rate across your customer base?

- How do you help with leasing team adoption and training?

- Are you a Credit Reporting Agency? How do our applicants handle disputes with their verification report?

- Do you ensure that the applicant’s name on the document matches the name on the rental application when verifying documents?

About Truework

Truework is a one-stop income verification platform that revolutionizes the tenant screening process for property managers and rental operators.

Truework Income for Tenant Screening combines various verification methods to assist property managers in verifying the income of up to 90% of applicants within 72 hours. By leveraging direct-to-source data from employers and payroll systems, it minimizes evictions due to fraudulent income information and saves leasing staff hours of manual work every week.

Ready to learn more?

To shorten approval times while mitigating risk, property management teams can look into AI-based tools to expedite the verification process.