The Importance of Mortgage Employment Verification and Benefits of Using Truework's Automated VOE

Balancing loan volume, processing times, and risk mitigation is a constant challenge for mortgage lenders. Ideally, lenders want to process loan applications quickly to keep their bottom line growing, but that becomes increasingly difficult as legacy providers continually increase the cost of consumer data.

While mortgage employment verification is a necessary part of due diligence and ensuring lenders only approve qualified buyers, it has traditionally been a source of frustration in the underwriting process. Traditional verification methods are often time-consuming and expensive, as they rely on manual workflows or costly data sources.

With Truework, lenders can take a more streamlined approach to employment verification that helps reduce costs while finding and closing qualified loan candidates.

Let’s take a closer look at employment verification, how it works, and how lenders can eliminate frustration by seeking modern solutions for fast, accurate, and streamlined verifications.

What is mortgage employment verification?

When a prospective homebuyer applies for a mortgage, lenders use verification of employment (VOE) to check the accuracy of the employment status and income information the applicant provided on their mortgage application.

Lenders can accomplish VOE by manually contacting the applicant’s employer, reviewing documents such as pay stubs and tax returns, or purchasing employment history data from third-party providers.

However, while these methods have been the status quo for mortgage companies for many years, there’s a better way to approach employment verification.

By orchestrating verification requests across multiple methods, Truework’s automated income and employment verification platform helps lenders verify applicant employment while keeping costs low and ensuring faster turnaround times.

Mortgage employment verification methods for lenders

Employment verification methods fall into two main categories: manual verification performed by the lender and verifications sourced through third-party providers.

Manual employment verification

Manual mortgage employment verification is when someone on the lender’s team contacts the employer listed on the application by phone to verify employment information, such as start date, position, and salary. When you consider loan volume, this can quickly become a time-consuming process.

Relying on manual VOE for mortgage applications also makes vendors more vulnerable to fraud. For example, an applicant may list their real employer but provide the phone number of a friend or family member who will confirm the applicant’s information.

Third-party VOE providers

Instead of manually verifying employment information, lenders can rely on third-party providers such as verification databases and user-permissioned data.

Third-party verification databases like The Work Number provide lenders with employment and income data they collect and aggregate from employers and payroll companies.

Although these legacy providers are widely used in the lending industry, they’ve become increasingly costly and time-consuming. The reason is lenders often need to go through multiple providers to verify an applicant because it’s difficult to find one provider who can verify all the data they need.

In contrast, user-permissioned data is a type of third-party verification that relies on direct-to-source data by asking applicants to permit lenders to retrieve data from payroll providers or financial institutions.

In effect, user-permissioned verifications let lenders bypass the middleman and get accurate, real-time data from reliable sources.

How Truework streamlines VOE for mortgage lenders

Relying on traditional mortgage employment verification methods like manual information checks and legacy data providers is expensive and frustratingly time-consuming. Yes, lenders want to reduce risk, but they also don’t want to lose qualified borrowers to a high-friction application process or long decision times.

Truework solves this problem for lenders by providing a one-stop income and employment verification platform that’s flexible and easy for both lenders and borrowers. Truework also saves lenders valuable time and leads to faster decisions by leveraging verification methods that take seconds or minutes instead of several days.

Here’s how Truework Income empowers lenders to reduce costs while mitigating risk and providing excellent borrower experiences.

Multiple VOE methods in one platform

Truework gives lenders access to multiple verification methods in one platform. That way, verifiers don’t have to juggle several providers.

Truework’s verification methods include:

- Instant: Instant verifications powered by 48+ million active employee records.

- Credentials: User-permissioned payroll data, including the ability to verify self-employed applicants.

- Smart Outreach: Automated manual income verification outreach.

With Truework, lenders get maximum coverage and the ability to verify 75% of applicants with one tool.

Intelligent verification method selection

When Truework orchestrates lender’s income verification requests across multiple methods, the platform automatically chooses the best method based on the applicant’s information. Intelligent orchestration means lenders get faster turnaround times and access to the industry’s highest completion rate of over 75%.

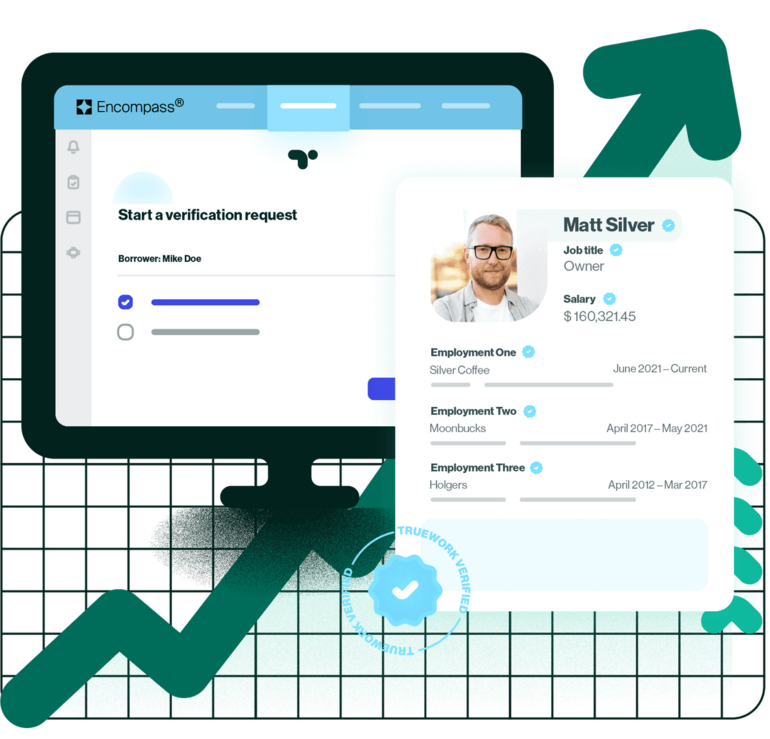

To allow for a more seamless mortgage employment verification process and applicant experience, Truework integrates with several loan origination system (LOS) platforms, including Encompass® by ICE Mortgage Technology®.

Transparency and performance tracking

Unlike many legacy providers, Truework provides full transparency into the status of each VOE request so mortgage lenders know which methods have been used. Loan officers can use this information to keep applicants in the loop and apprised of information requests.

Moreover, Truework only charges for completed verifications, not each attempt, which means lenders can keep their costs low. Beyond tracking each individual request, Truework Admins have access to user-friendly dashboards that track detailed performance metrics, such as turnaround times and completion rates.

Trustworthy verifications

Truework is dedicated to serving the mortgage industry with innovative tools and reliable information that allows lenders to close home loans faster.

Toward that end, Truework is an authorized report supplier for Fannie Mae’s Desktop Underwriter® (DU®) validation service, a component of Day 1 Certainty® for mortgage lenders, and operates as a Credit Reporting Agency under the Fair Credit Reporting Act (FCRA).

Furthermore, Truework combines high-quality third-party data and industry best practices to ensure the reliability of each verification method.

With Truework Credentials, lenders can access accurate and up-to-date payroll data for 1099 and W2 workers. Truework’s Smart Outreach mitigates risk for manual verifications by sourcing employer contact information from third parties instead of relying solely on applicant-supplied information.

User-friendly verification processes

New technology can only be as effective as its user experience. Lenders won't enjoy the benefits of a VOE solution if loan officers or applicants can’t figure out how to use it. That’s why Truework’s platform is designed to be easy to use for both parties.

Lending teams can submit verifications through a web app or integrate it into their application process through Truework’s API, allowing them to choose the best option for their existing processes.

On the applicant’s side, Truework provides step-by-step guides that walk individuals through the verification process, clearly state what data will be collected, and let them know when they’ve successfully verified their information.

Verify employment for mortgages with Truework

Employment verification is an essential part of the mortgage process. It helps lenders find applicants who can reliably pay their mortgages and avoid issues such as loan defaults, buybacks, and foreclosures.

That said, verifying employment and income has traditionally been a frustrating, time-consuming, and increasingly costly process for lenders. With Truework, lenders no longer need to rely on manual verifications or a handful of legacy providers.

Truework’s one-stop income and employment verification solution gives lenders access to streamlined and cost-effective employment verifications by orchestrating verification requests across multiple methods.

Ready to learn more?

Learn more about Truework today and see how you can use automated VOE in your mortgage process to reduce costs, mitigate risk, and increase completion rates with one platform.